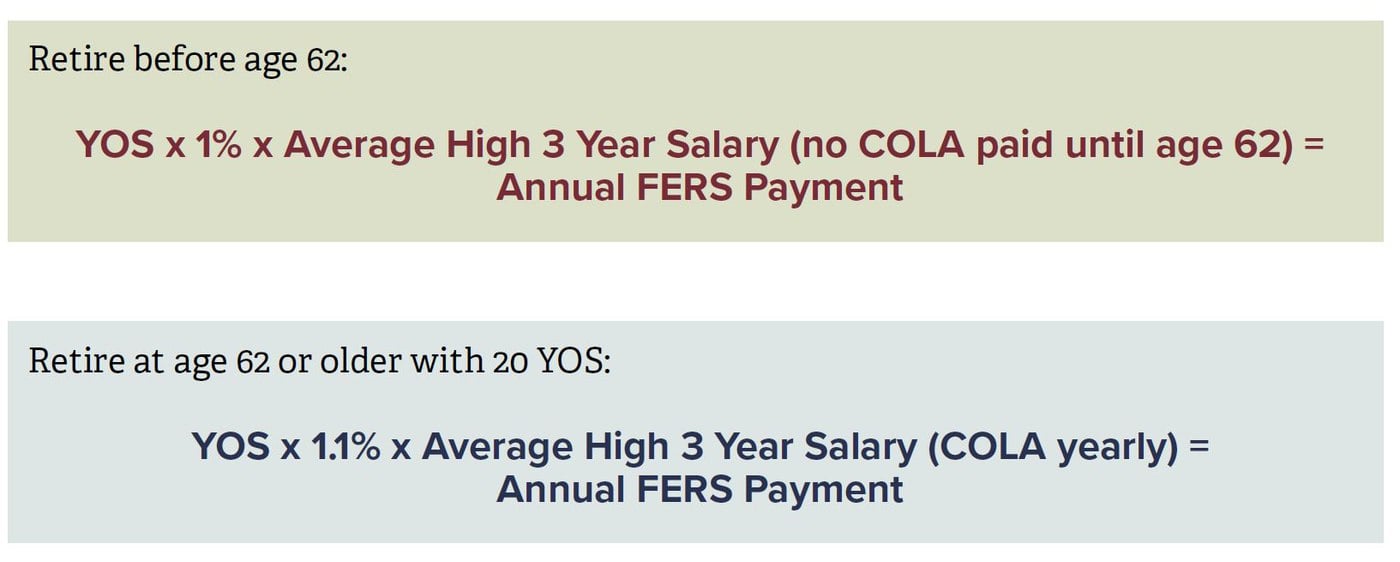

Calculate Gs Retirement - Some people who are eligible for a regular FERS withdrawal will also get a special 10% bonus. If you retire at age 62 (or older) and have at least 20 years of creditable service, your pension receives a 10% bonus.

Your FERS retirement pension is determined by your High-3 salary, your years of service, and a pension multiplier.

Calculate Gs Retirement

But if you retire at age 62 or older with 20 or more years of creditable service, your pension multiplier is 1.1%.

Solved 5. Retirement Plans Psb 3 2 Calculate Gross Pay And

That's a 10 percent bonus! And you get the benefit of that bonus for life.

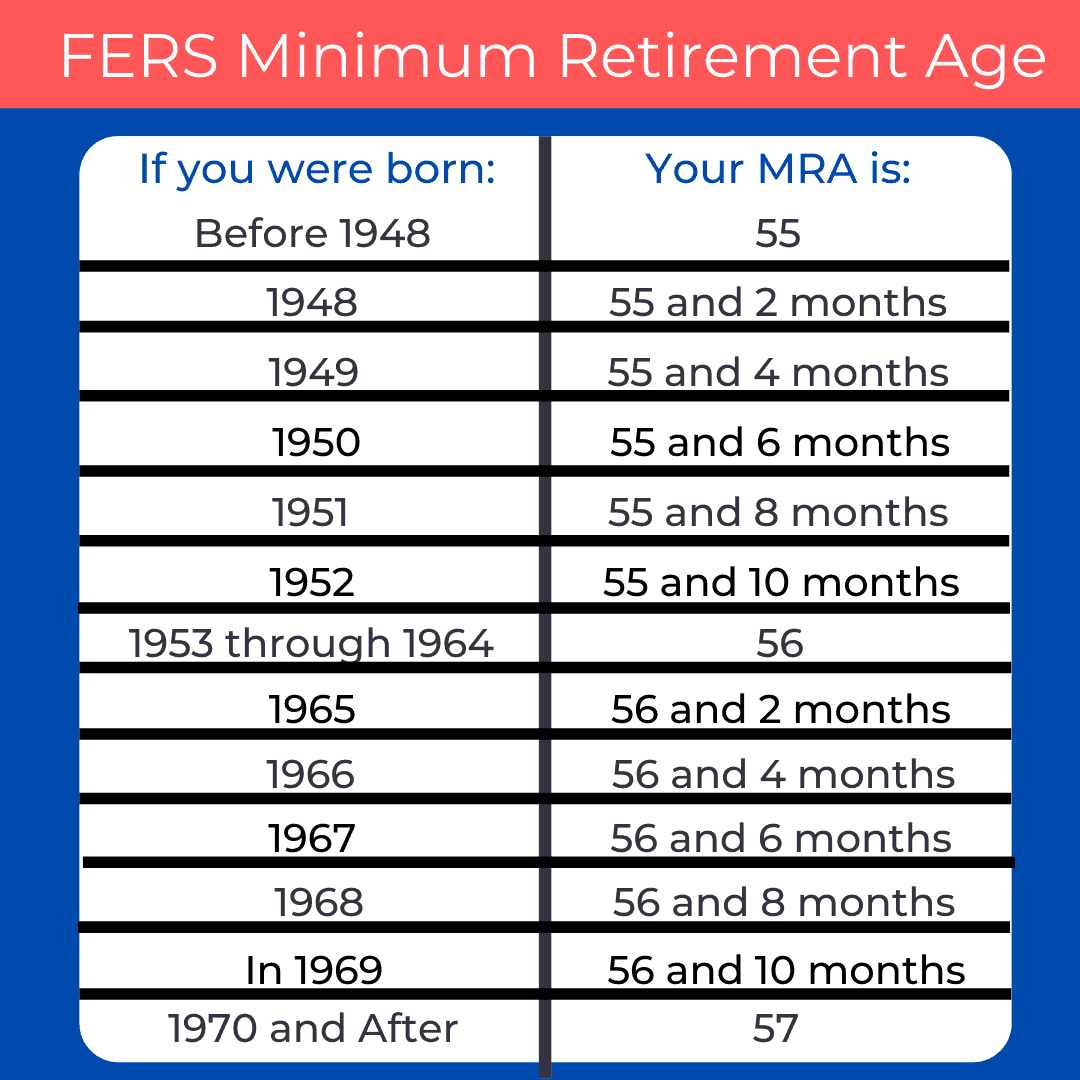

To qualify for the bonus, you must be at least 62 years old at retirement with at least 20 years of creditable service.

You should also file an immediate withdrawal with FERS. This means that if you took a FERS deferred withdrawal, you would not be eligible for this bonus.

For more details on the allowance, you can refer to Chapter 50 of OPM's CSRS / FERS Handbook. This allowance is referred to in subsection 50B3.1-1 B.

What Is The Average Pension For A Retired Government Worker In California?

When people read that section, they sometimes worry when they see "NOTE 2: Employees who are 62 years old at retirement are not eligible for supplemental retirement income." We'll talk more about this in a moment.

Are you now eligible to withdraw under the normal FERS withdrawal rules, but trying to decide if you should stay for the 10% bonus?

Everyone's personal situation is unique. But let's look at some examples that will help you evaluate your situation.

Let's say you are 61 years old with 20 years of service. This means you are now eligible to withdraw under the FERS withdrawal rules.

How To Calculate Your Fers Retirement Benefit

But you're wondering if it makes sense to work just one more year when you retire at age 62 and get your bonus…

Let's look at some sample pension calculations to see how much of a difference the added bonus makes to your FERS retirement.

We have someone with a $55,000 High-3 that has 20 years of service. If they are not yet 62 when they retire, the pension will be calculated as...

But what if you have someone with the same High-3 and the same years of service, but was at least 62 years old at retirement.

Ers Tier 6 Benefits

In these examples, we have kept years of service the same to see the effect of the bonus. And here the difference ($1008 - $916) is $92 more per month.

If you're trying to decide whether to dig it now, or wait another year, there's more to consider.

If you work for another year, you have many things going for you that can increase your pension by more than 10%.

Let's go back to the first part of the example, where we say you are 61 years old with 20 years of service and a $55,000 High-3.

Calculating Fers Disability Retirement

However, if you worked another year and retired at age 62, with 21 years of service and a High-3 of $56,000, your FERS retirement pension would be calculated as…

And not only will you benefit from that higher pension for the rest of your life... if you draw a survivor annuity, your survivor benefit is based on that higher amount for the rest of your life as well.

Looking at our example, if you retired at age 61 with 20 years of service, your gross monthly pension would be $916.

In this case, if you choose a "full" survivor annuity (meaning your survivor receives *half* of your pension when you die) - it will cost 10% or $91.60 - and your survivor will receive $458/month has

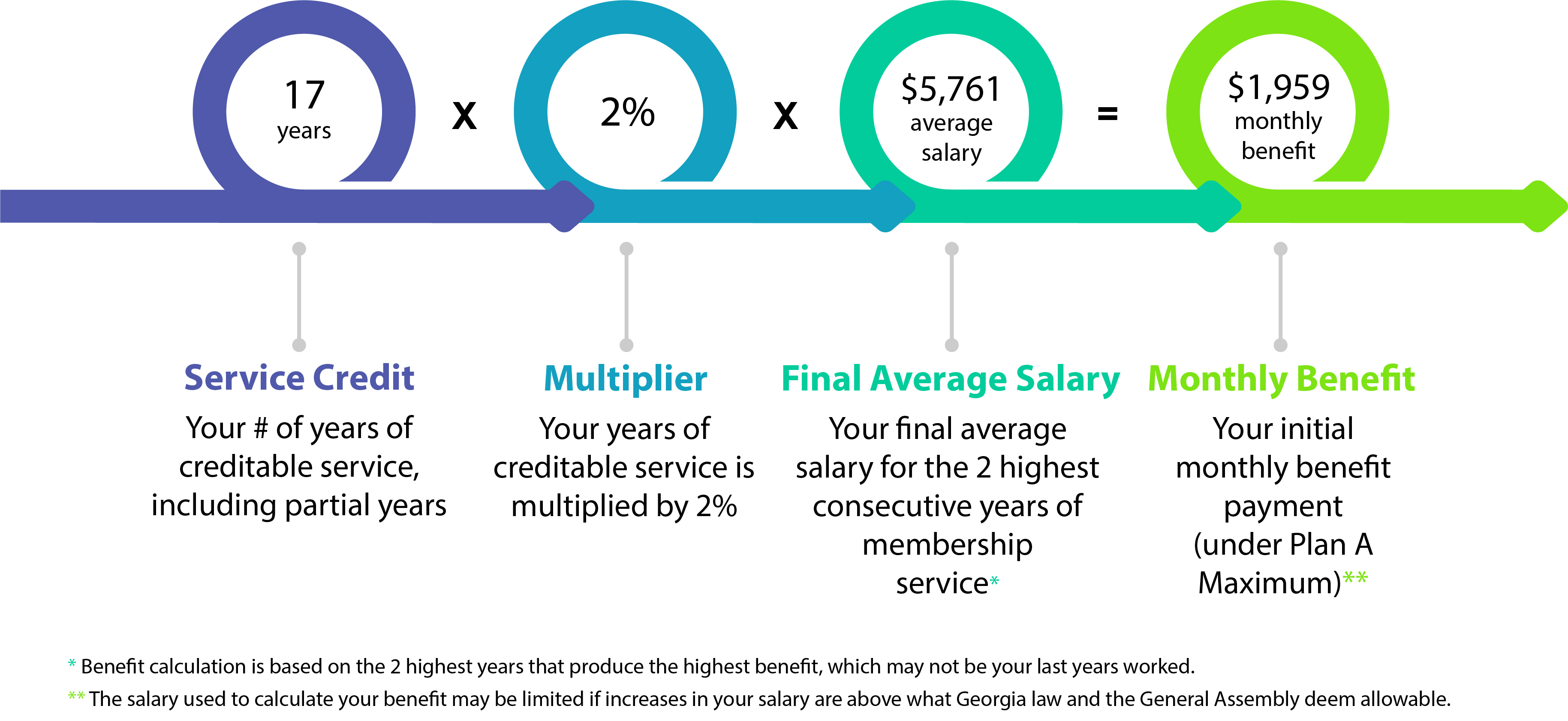

Teachers Retirement System Of Georgia

However, if you work another year and retire at age 62 with 21 years of service, your gross monthly pension would be $1,078.

Now, if you choose the "full" survivor benefit (where they get half)...it will still cost 10% - which is now $108 - but your survivors would receive $539 per month.

So by working that extra year, your gross pension ($1,078 - $916) was $162 higher every month of your life. And when you leave your survivor benefit ($539 - $458) it will be $81 higher every month for the rest of his life.

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Please note that we are only talking about gross pension amounts here. The current FERS retirement pension you will receive is subject to survivor benefits, FEHB, taxes, etc. But we have only talked about big numbers to cover the concept.

Calculating Your High 3 Salary

One concern people raise is that if they wait to retire at age 62, they will "lose" their FERS supplement.

And yes, that is correct. If you retire at age 62 or later, you will not receive the FERS supplement.

So if you retire at age 61, you will receive a pension of $916/month and a supplement of $500/month. $916 + $500 = $1,416 / month.

And technically, the bonus is higher than the $1,078/month pension you would have received if you had worked another year and given up Supplemental FERS.

Your Personal Benefits Statement

*BUT* keep in mind that you only get the supplement for one year, because the FERS supplement stops at age 62. And regardless of whether you start Social Security or not, the FERS supplement automatically stops at age 62.

If you work overtime to get a 10% bonus - you get the benefit of that bonus for life. And if you choose a survivor annuity - its benefits will be even greater.

Also, don't forget that if you work another year, you have received the full salary that was another year.

So if you worked another year until age 62 - yes - you'll give up $6,000 in FERS Supplemental Retirement, but in this case you'll get a full salary of about $56,000... a higher pension estimate for the rest of your life.

The 5 Best And Worst States To Retire In 2023

If you are 61 years old, have 20 or more years of service and are thinking of working another year to get the extra bonus, we encourage you to do so.

That 10% bonus will be with you for the rest of your life. And if you make a survivor annuity - your survivor's amount will be even higher.

I've had many clients who were thinking about retirement before they got the bonus (they didn't know about the bonus when they started thinking about retirement).

At the age of 61 years and 9 months he had to retire with 20 years of service. They didn't need the extra money, but they were so close that they ended up working those extra months for the bonus. And now they are retired and appreciate a bigger pension every month.

Federal Employee Retirement News And Information

But I've had other clients who were just a few months away from getting their bonus but chose to withdraw anyway. They were so willing to work that the bonus was not enough to induce them to stay longer. They were done - bonus be darned.

For most federal workers I talk to - a 10% bonus won't make or break their retirement plans. But it can definitely be a big help.

And I encourage you not to get the full number of links to try to get the biggest pension possible at all costs.

Retirement planning is about more than numbers. Numbers are important, yes. But they are only one part of real retirement planning. Considering your own happiness (and health) is also important.

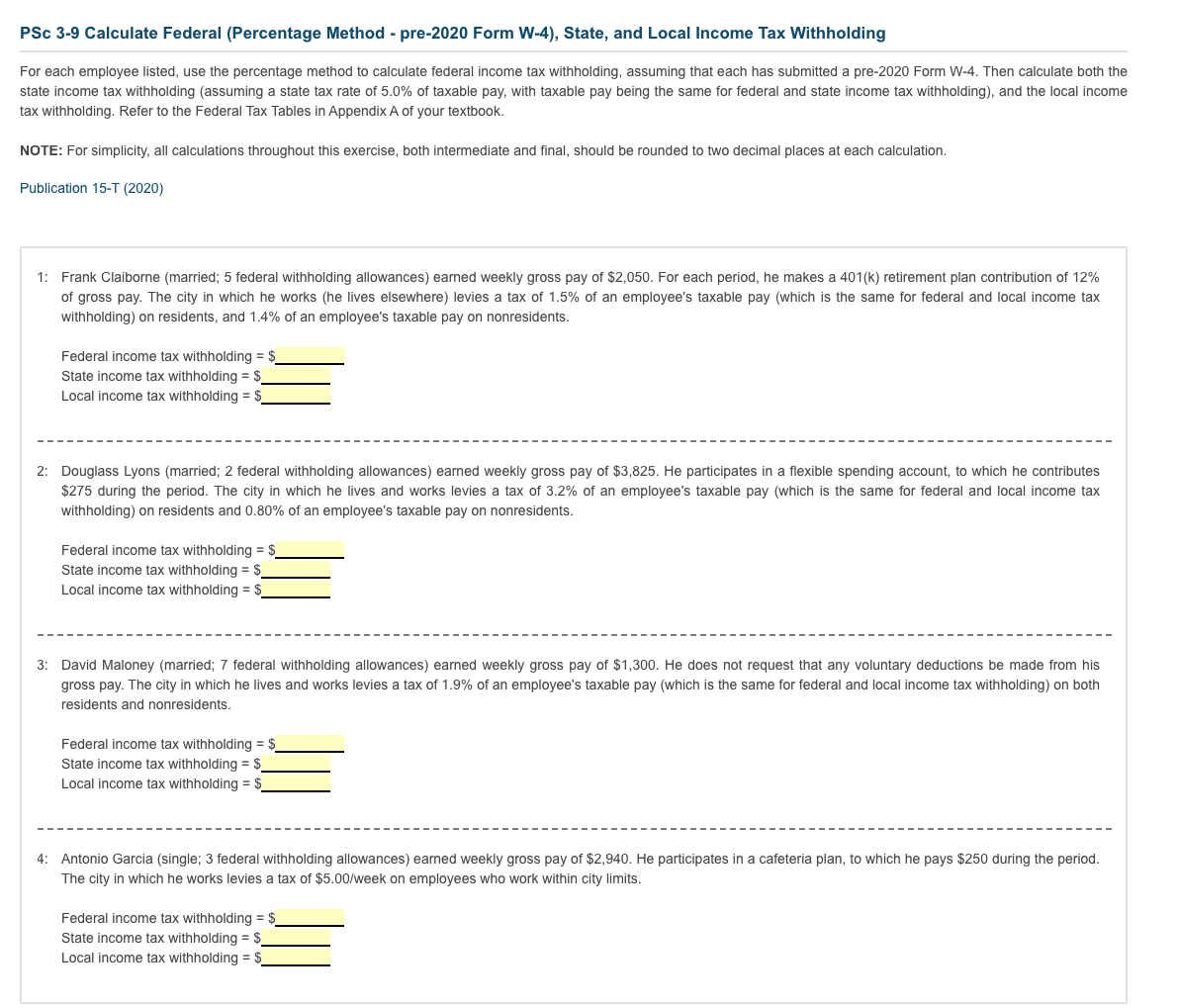

For Each Employee Listed, Use The Percentage Method

You have to make the best choice for your personal situation, but it's important to know your options first. Whether you decide to stay for the bonus or not - I hope you understand your options so you can make the best decision for your personal situation.

This is something I help my federal employee clients with. Do you need help with your personal situation? Click here to learn how I help my clients.

Your federal retirement benefits are only one part of your overall financial picture. Make sure you take a look at your entire financial picture before making any big decisions.

Many federal employees have never heard of the 10% FERS retirement bonus. If you've learned something new, please tell your friends and colleagues. They might even learn something new. 🙂

Fers Annuity Calculations

We see the mistakes that people (and even some professionals!) can make, and we want to help them avoid them. Click the button below to learn more.

"I'm in the divorce process (before my federal retirement). I want to agree to pay my partial survivor annuity soon and he's okay with it.

"Can I withdraw my FERS to use as a down payment on a real estate purchase?" - Tracey. https://www.youtube.com/watch?v=CPm4DDHl0-c&feature=youtu.be When Federal Employees Use Their Pension Benefits to Buy a Home

"I am a retired federal FERS employee (age 65). I saw your episode about a "direct transfer" of tsp funds to an IRA, and then the next one.

Fers Retirement Special 10% Bonus: Age 62+ With 20+ Years Of Service

"Hi Micah, I'm so glad I found your website. I've been reading a lot of material and watching a lot of podcasts.

Military drone range, laser range finder military, military range bags, military range targets, long range military radio, military radio range, military range finder, military long range binoculars, range rover military discount, military range rover, range of military drones, military range bag

0 Comments